Investing in Baylor's Future

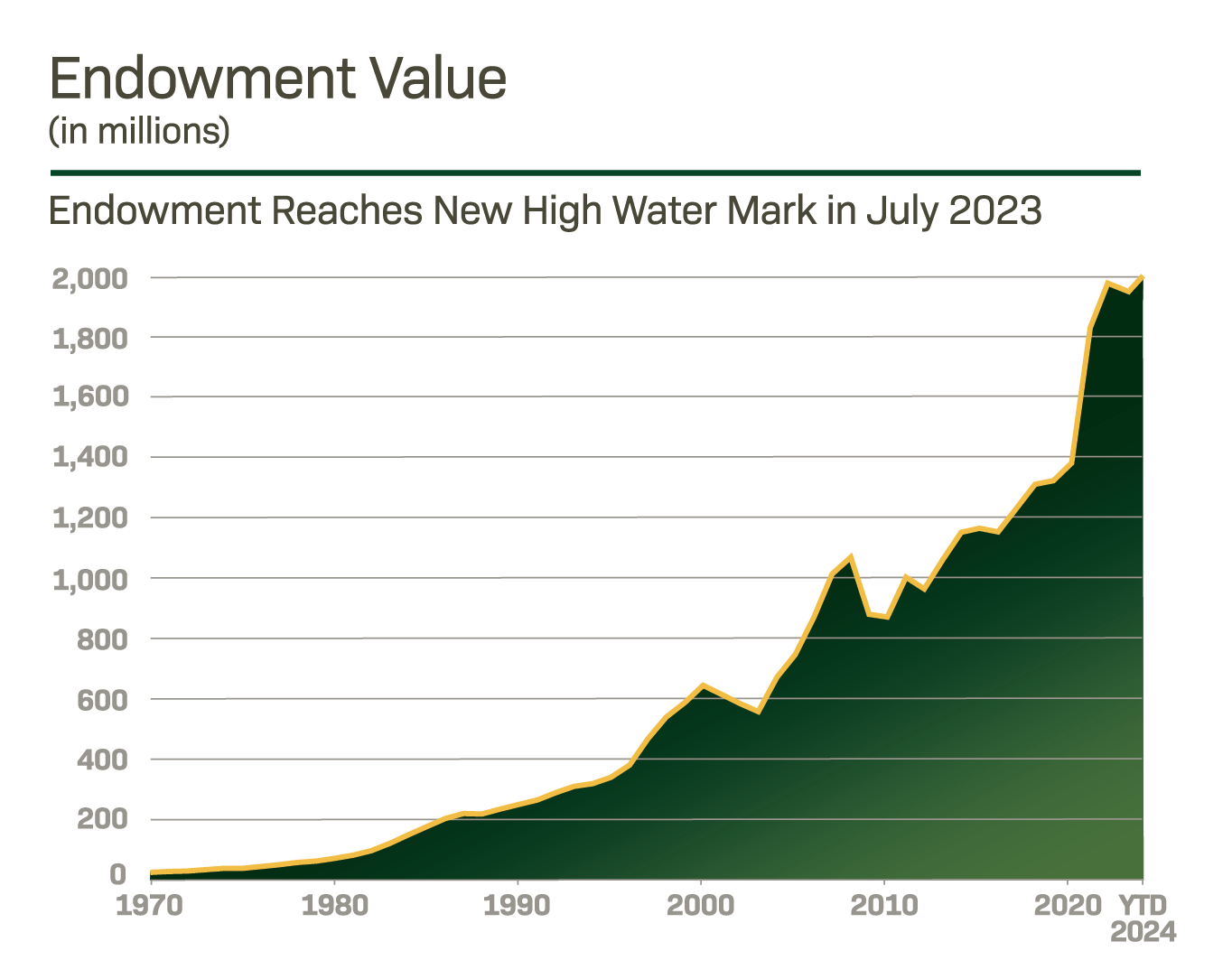

The Office of Investments is responsible for managing Baylor’s endowment and other long-term investments of the University. The $2.0 billion endowment portfolio supports the affordability and quality of a Baylor education today and for generations to come. $82 million was distributed from the endowment to the University over fiscal year 2023 in support of scholarships, professorships, and other mission-related activities of the University.

Meet Our Team

The Office of Investments is composed of a strong team of investment professionals that are experienced in investing across all aspects of the globally diversified Endowment portfolio.

Marketable Investments

Private Investments

Private Investments

Marketable Investments

Private Investments

Baylor's Endowment

A growing endowment is essential to keeping a Baylor education affordable for deserving students of all economic backgrounds, and it is an important determinant of our long term competitiveness with other top-tier institutions. Investment returns from the endowment portfolio and ongoing gifts from alumni and friends are essential to the healthy growth of Baylor's Endowment. The portfolio is invested with a target return that provides for monthly distributions to support students on campus today while more than keeping pace with inflation to enhance the endowment's purchasing power for generations to come.