Baylor University's Endowment

Baylor’s endowment distributed $82 million in scholarships, professorships, and other university initiatives over Fiscal Year 2023. A growing endowment is critical to Baylor’s continued fulfillment of its distinctive mission as a preeminent Christian university. Endowed funds foster the long-term affordability and educational excellence essential to attracting talented students in the competitive higher education marketplace.

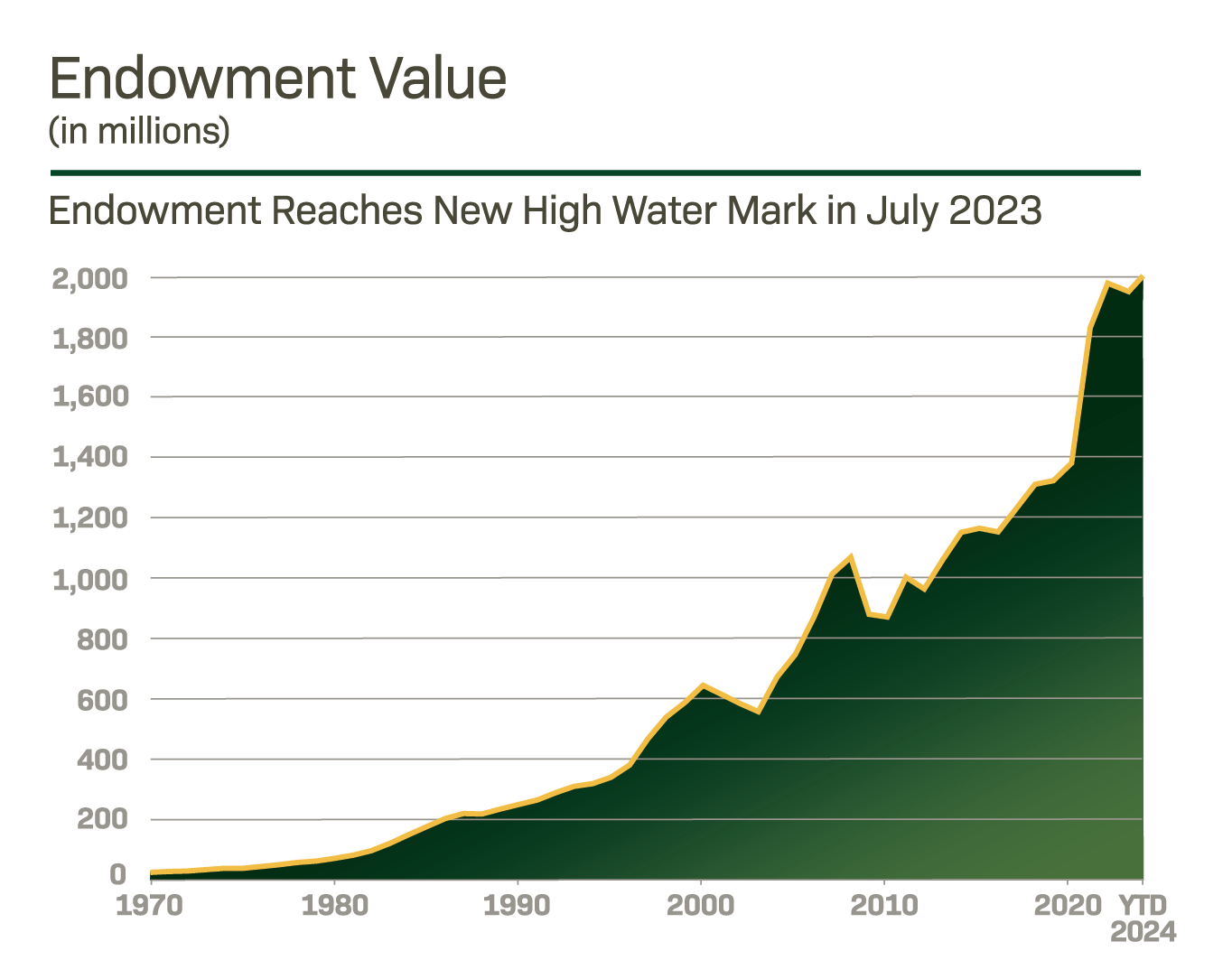

Endowment Value

Baylor’s endowment reached a new all-time high in July 2023. Continuing to grow the endowment is a key initiative of the University. Ongoing gifts from alumni and friends along with annual investment returns from the endowment portfolio are foundational to the continued advancement of the University.

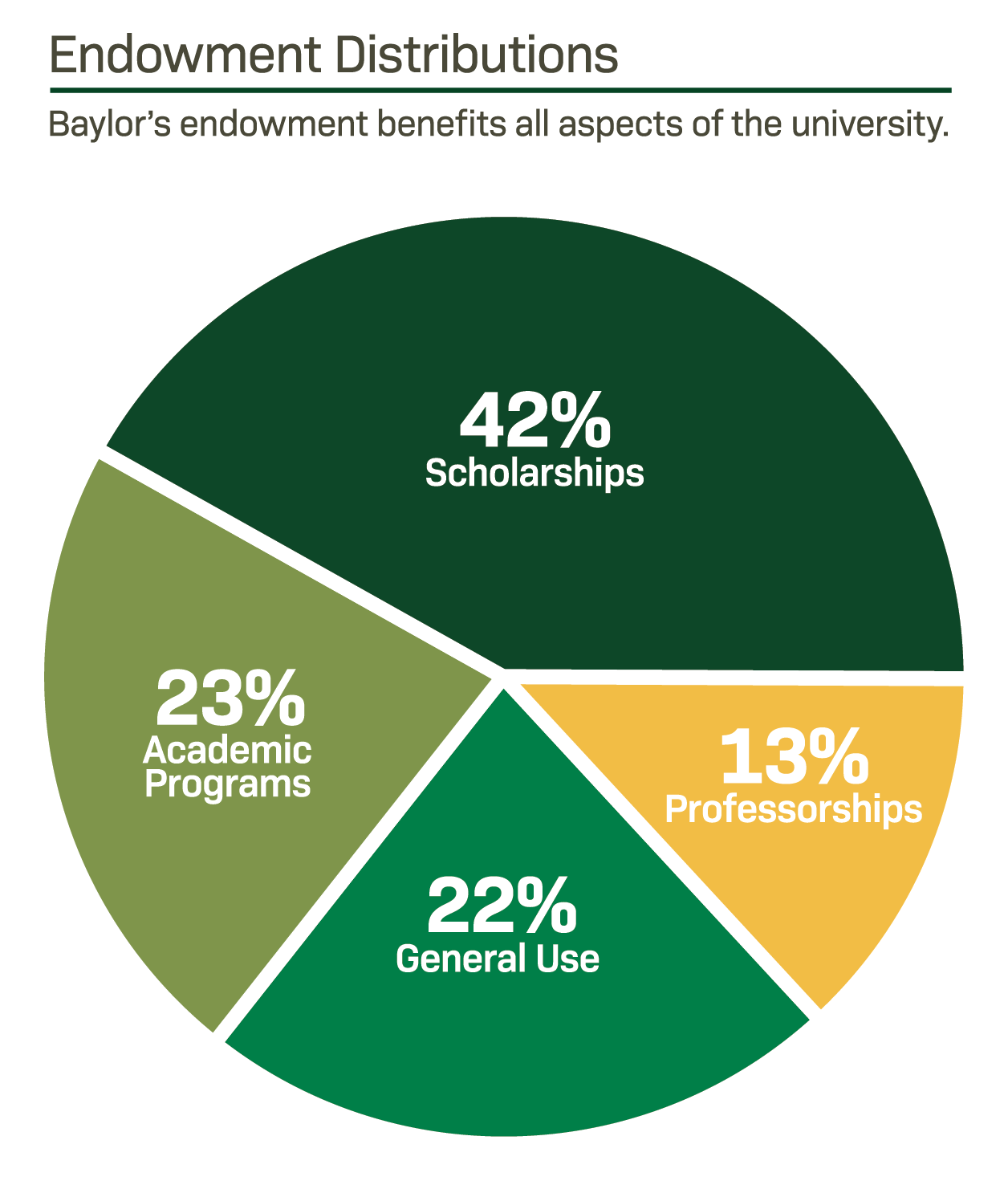

Endowment Distributions

Approximately 5% of the endowment’s value is distributed to the University each year in monthly installments. Distributions from the endowment support students, professors, and academic programs. In the fiscal year 2023, Baylor's endowment distributed $82 million to the university. Of those distributions, 42% went to scholarships, 13% to professorships, 23% to academic programs, and 22% to general use.

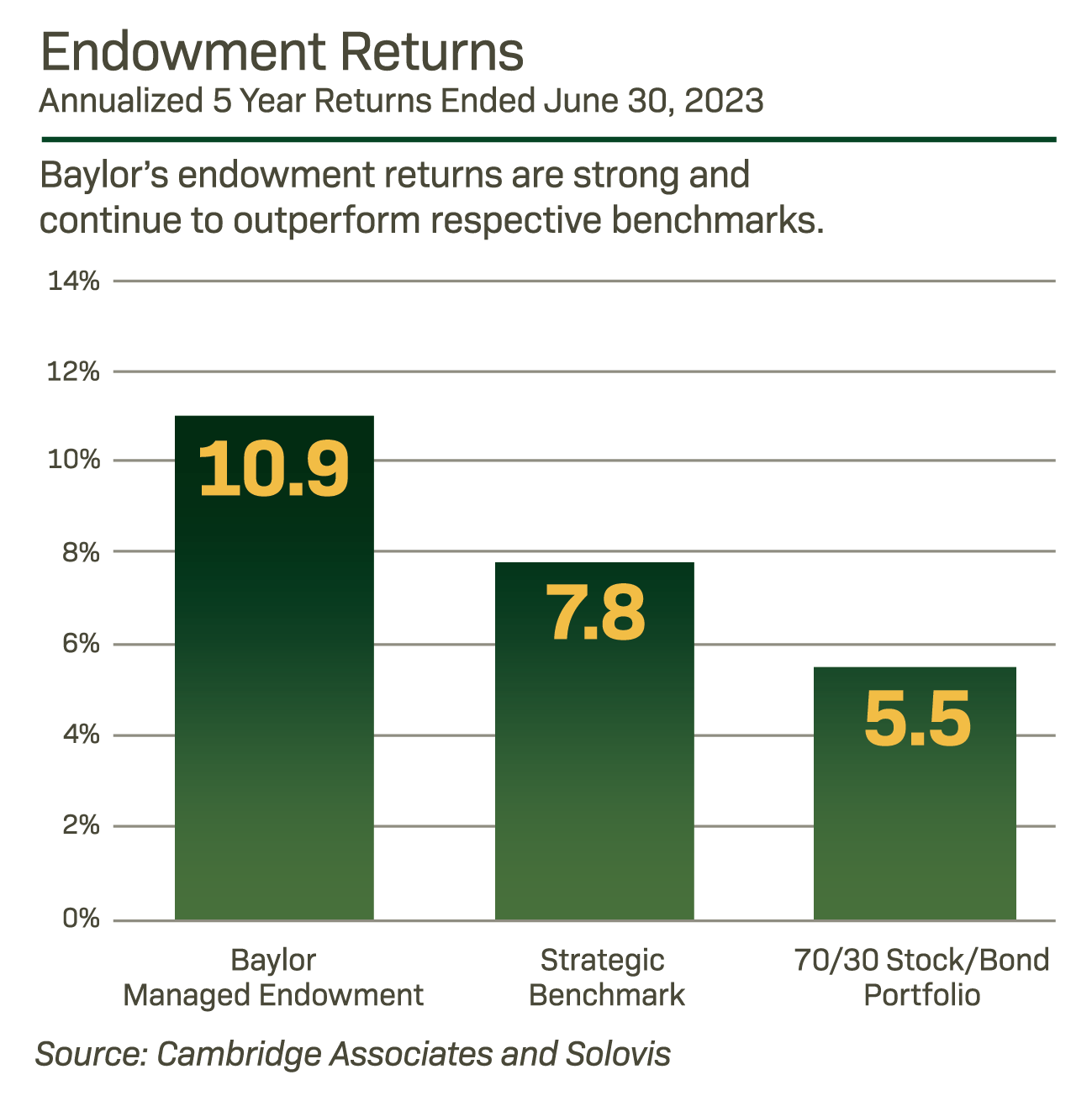

Endowment Returns

Baylor’s endowment returns are strong and exceed its respective benchmarks. The portfolio’s policy benchmark represents a strategic blend of stock, bond, alternative, and private investments consistent with the largest and best performing endowments across the United States. Managing Baylor’s endowment against this diversified benchmark enhances long-term value through strong returns with better downside protection.

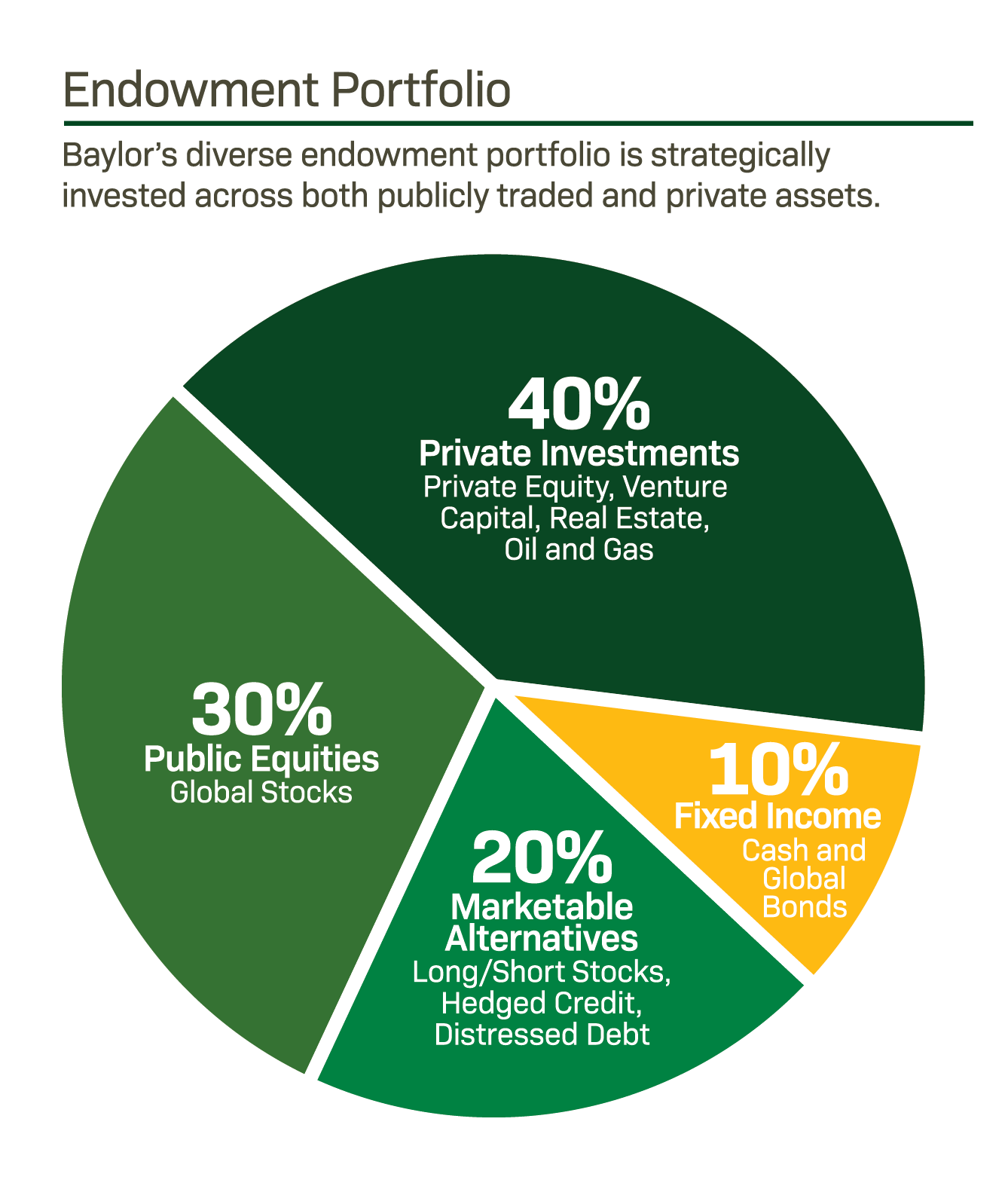

Endowment Portfolio

Baylor’s endowment portfolio benefits from a diverse blend of stock, bond, alternative equity and debt, and private investments. Investing within strategic ranges for each of these investment types serves as a control mechanism for the overall risk of the portfolio. Tactical shifts within approved ranges provide the flexibility to adjust risk as market conditions vary and to reposition the portfolio as technological innovations occur. Diversity and flexibility allow the Office of Investments to optimize the long-term value of the endowment with more stable returns that successfully compete with the top performing endowments in the U.S.

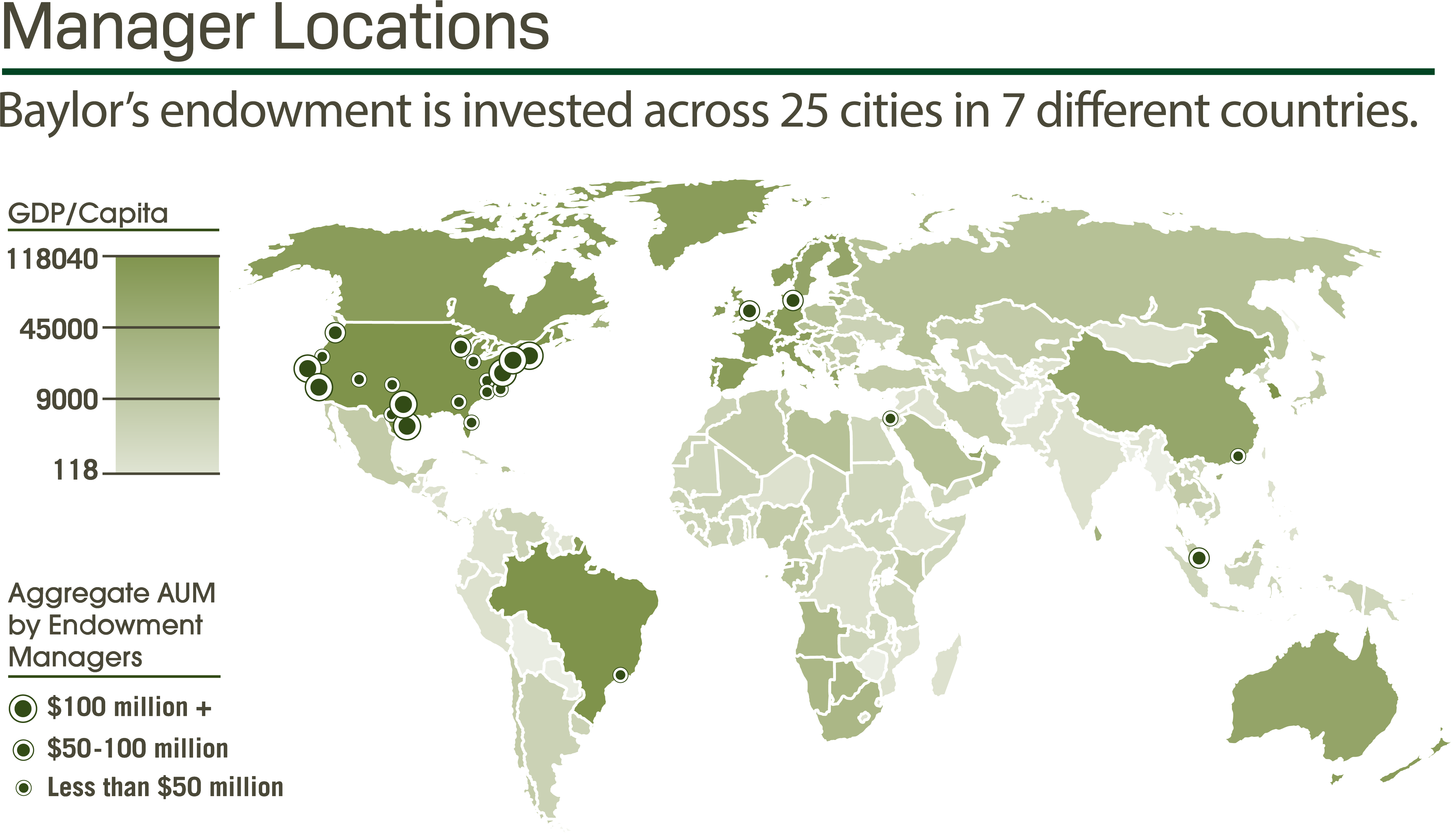

Portfolio Managers

The endowment portfolio is invested with more than 80 managers located in 25 cities across the globe. These managers are evaluated by the Office of Investments as the best and brightest in their various areas of expertise. Extensive due diligence is performed before a manager is brought into the portfolio. Every selected manager is a proven professional who exhibits the highest level of integrity and fiduciary responsibility, practices operational transparency, and follows institutional quality valuation and reporting standards.

Investing in a Rapidly Changing World

Technological innovations in healthcare, energy, transportation, manufacturing, information technology and most other economic sectors are changing the investment landscape today. Changes of this magnitude create opportunities for the astute investor. Investments in companies best able to adapt and benefit from the technological advances such as those referenced here will be rewarded. Equally important is avoiding those companies that are slow in making changes needed to compete in a more technologically advanced world.

Electric/self-driving/shared vehicles have broad implications beyond the replacement of internal combustion engines.

3D pringing enables the manufacturing of increasingly complex and smaller production parts while mitigating inventory needs.

Robotic technology is becoming increasingly effective at replacing formerly complex human tasks.

Artificial Intelligence is still nascent but will increasingly enable the automation of more complex roles traditionally performed by humans.

Alternative Energy Sources are re-ordering the power generation stack around the globe.

Genetically Targeted Medicines increasingly harness the body's immune system to attack previously incurable diseases.